Bonk gears for 10% rally next week

Bonk, the dog-themed utility token, wiped nearly 14% of its value in the last seven days. The fifth-largest meme coin by market capitalization has observed a large volume of capitulation in the past week.

However, technical indicators point at likelihood of gains next week.

Bonk price forecast

Bonk (BONK), a Solana-based meme coin with a market capitalization above $1.436 billion, saw its price decline last week.

Even as analysts observed capital rotation from large market cap tokens to smaller cryptos and Solana-based memes, BONK price lagged behind, while blue-chip DeFi tokens like Dogwifhat (WIF) led in gains.

BONK price slipped 14% in the last seven days, after posting nearly 60% days in the past month.

The daily and weekly price charts show mixed signals. Technical indicators like MACD are bullish on the weekly price chart, signaling an underlying positive momentum in BONK price trend. RSI reads 48, hovering close to the neutral level.

BONK trades at $0.00001875 at the time of writing and the closest resistance is the lower boundary of a Fair value gap on the weekly price chart, at $0.00002039. The closest support for the meme coin is the lower boundary of a bullish imbalance zone, at $0.00001572.

The daily price chart shows a negative outlook, meaning further correction is likely over the weekend. While BONK is in an upward trend, price has slipped into the imbalance zone. Once BONK collects liquidity, it could attempt a rally to resistance at $0.00002039 and $0.00002581, key levels marked by lower boundaries of FVGs on the daily timeframe.

The RSI reads 49, close to neutral and MACD flashes red histogram bars above the neutral line, meaning that there is an underlying negative momentum in BONK price trend.

Traders need to watch the daily price chart and indicators closely for signs of reversal, if RSI slopes upward or MACD flashes green histogram bars, it could support a bullish thesis on the daily timeframe.

On-chain and derivatives analysis

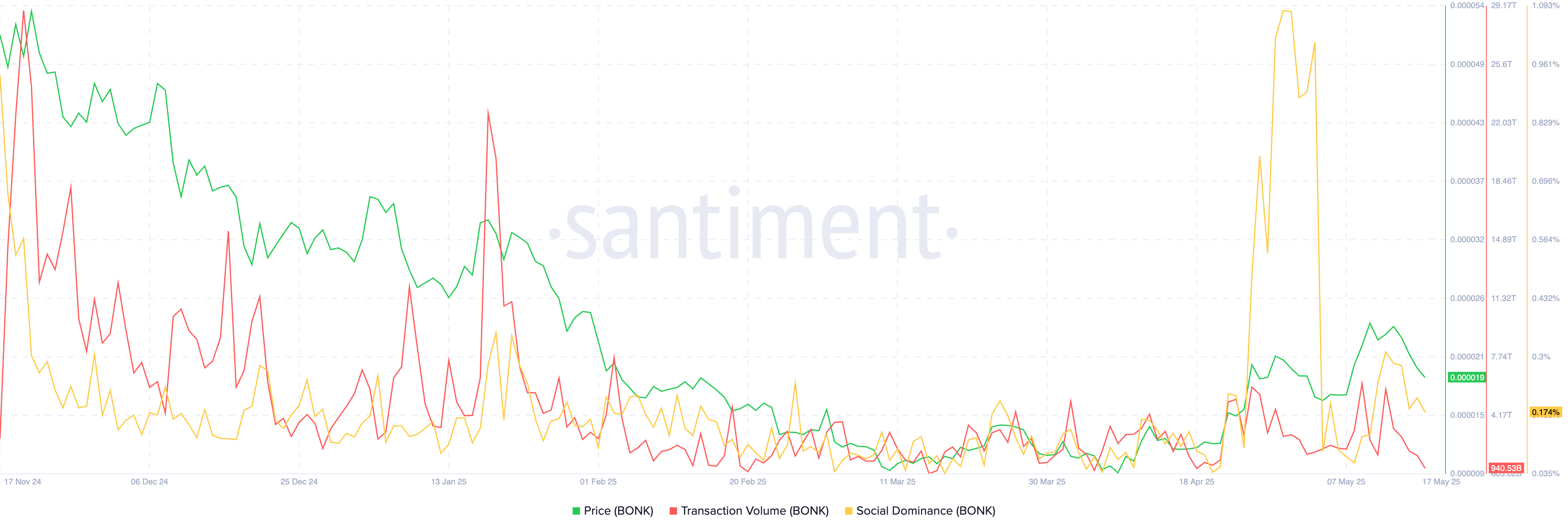

On-chain data from crypto intelligence tracker Santiment shows the transaction volume and social dominance of BONK suffered last week.

Transaction volume represents the activity of BONK traders across exchanges and social dominance represents the share of BONK relative to other cryptos in mentions in social media, on X, and other platforms.

A decline in transaction volume and social dominance signals likely disinterest or fatigue among BONK holders. However, it could be a positive development for BONK since the metrics do not point to a relative increase in selling pressure or other factors that could usher further correction in the Solana-based meme coin.

Derivatives data from Coinglass shows a large volume of long liquidations, as opposed to shorts, in the last 24 hours. This is in line with the price decline observed in the last seven days. Coinglass data shows over $251,000 in long positions were liquidated, against $2670 in shorts.

The long/short ratio on OKX exceeds 1, it reads 1.81 at the time of writing. This indicates that derivatives traders on the platform are bullish on an increase in BONK price.

Top catalysts driving gains in BONK

Aside from on-chain and bullish indicators, key market movers like Bonk’s partnership announcement with a Nasdaq listed firm, DeFi Development Corp for its meme coin validator launch on may 16, are likely to drive gains in the Solana-based meme token.

This development is pivotal to the BONK community, as it represents the first partnership of its kind between a Nasdaq-listed firm and a meme token based on the Solana blockchain.

According to the Bonk team, it expands validator coverage, contributes to the growth of BONKSOL, the community-run Liquid Staking Token, and reinforces the decentralization of Solana’s architecture.

As BONK runs a pilot, it lays the blueprint for a partnership between meme tokens and publicly listed firms to support the Solana blockchain and decentralization.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.