344k New Users Pop Up As BTC Breaks $103k

On-chain data shows address generation on the Bitcoin network has spiked as BTC has rallied above the $103,000 level.

Bitcoin Network Growth Has Been On The Rise Recently

In a new post on X, the on-chain analytics firm Santiment has talked about the latest trend in the Network Growth of Bitcoin. The “Network Growth” here refers to an indicator that keeps track of the total number of new BTC addresses being created by users every day.

An address is said to be ‘created’ when it comes online on the network for the first time. In other words, when it makes its very first transaction. A number of factors can contribute to a spike in address generation.

New users joining the network and old ones who had sold earlier coming back, both naturally lead to an increase in the Network Growth. The metric also goes up whenever existing users create multiple wallets for a purpose like privacy.

In general, all three of these factors can be assumed to be at play to some degree whenever the Network Growth observes a spike. Thus, some net adoption of the cryptocurrency could be considered to have occurred.

Now, here is the chart shared by the analytics firm that shows the trend in the Bitcoin Network Growth over the past month:

The value of the metric appears to have been on the rise in recent days | Source: Santiment on X

As is visible in the above graph, the Bitcoin Network Growth has witnessed an increase alongside the recent price recovery rally, indicating that demand for creating BTC addresses has been on the rise. This trend isn’t anything surprising, as investors usually find sharp price action like rallies to be exciting, so they tend to be drawn to the blockchain during such periods.

In fact, BTC rallies have historically only been successful when they have been able to amass a sufficient amount of attention, as it’s only with the fresh capital coming into the asset that these runs can acquire the fuel they need to keep going.

In the past day alone, when Bitcoin has surpassed the $103,000 level, the investors have opened up a total of 344,620 new addresses on the network, thus suggesting a notable influx of users.

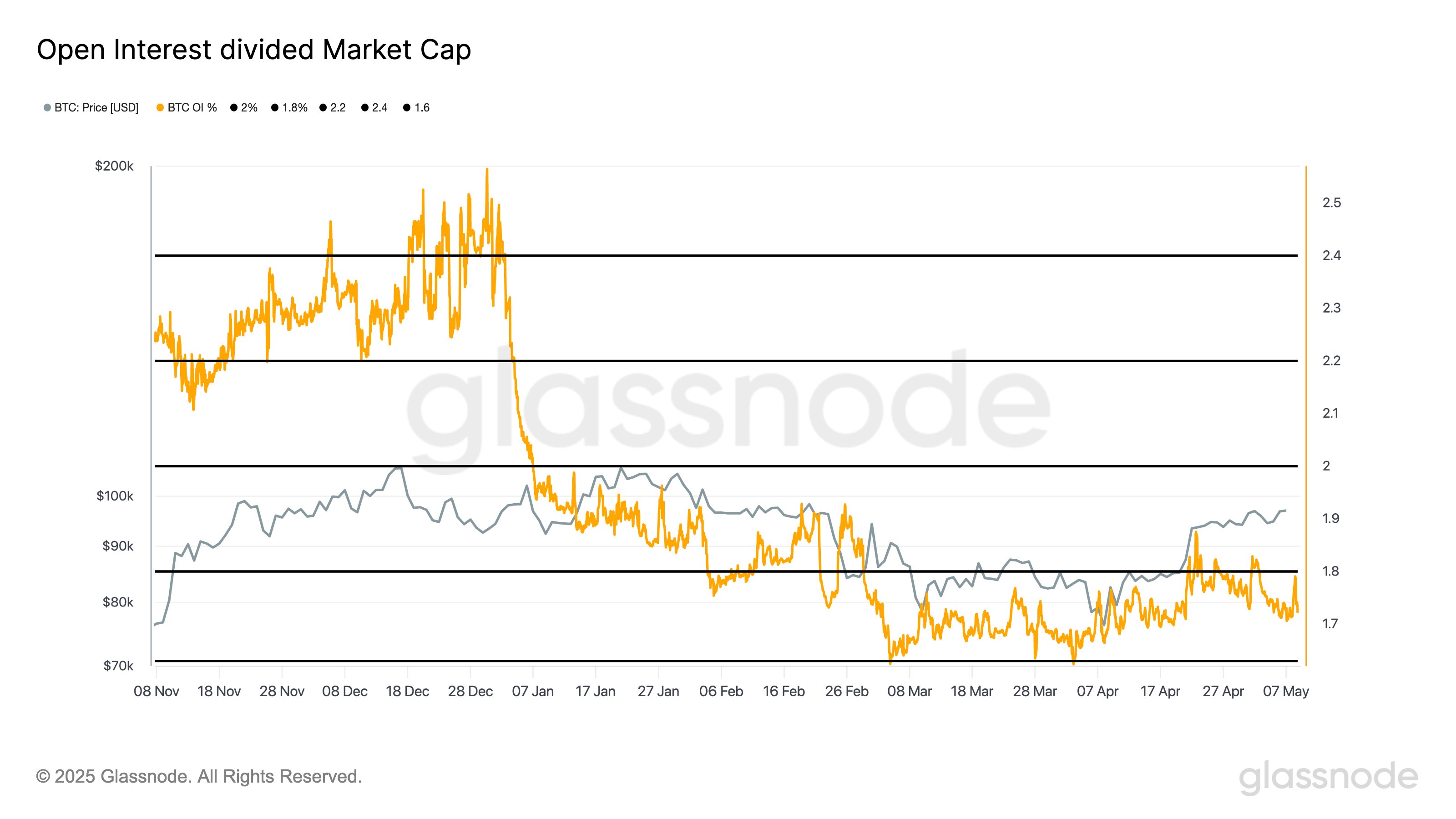

In some other news, the BTC Open Interest has remained low relative to the market cap recently, as analyst James Van Straten has pointed out in an X post.

The trend in the ratio between the BTC Open Interest and market cap | Source: @btcjvs on X

The “Open Interest” is a metric that measures the total amount of derivatives positions related to Bitcoin that are currently open on all centralized exchanges. In the past, spot-driven rallies have had higher chances of being stable, so the Open Interest being low right now could prove to be a positive sign for the asset.

BTC Price

At the time of writing, Bitcoin is trading around $103,500, up almost 7% in the last seven days.

Looks like the price of the coin has rocketed up during the past few days | Source: BTCUSDT on TradingView

Featured image from Dall-E, Santiment.net, Glassnode.com, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.