Best Low-Fee Crypto Trading Platforms 2025 CoinCodeCap

Cryptocurrency trading has surged, with Bitcoin hitting an all-time high of over $109,000 in January 2025. However, trading fees can erode profits, especially for frequent traders. The cheapest crypto exchanges with the lowest fees, such as MEXC, Binance, and Kraken, offer cost-effective solutions by minimising or eliminating maker and taker fees. This article explores the top 10 platforms in 2025 that provide the lowest crypto exchange fees, detailing their fee structures, features, and considerations to help traders maximise returns. By focusing on keywords like “cheapest crypto exchange” and “crypto with lowest fees,” we aim to guide users toward platforms that optimise trading efficiency.

What Are Low-Fee Crypto Exchanges?

Low-fee crypto exchanges charge minimal or no maker and taker fees, which are typically 0.1% to 0.5% per trade on traditional platforms. Maker fees apply to orders that add liquidity (e.g., limit orders), while taker fees apply to orders that remove liquidity (e.g., market orders). These exchanges often rely on alternative revenue streams, such as:

- Wider Spreads: Earning from the difference between buy and sell prices.

- Withdrawal Fees: Charging for transferring funds out of the platform.

- Subscription Models: Offering low-fee trading for premium members.

- Token Discounts: Reducing fees for users holding exchange tokens like BNB or MX.

Types of Low-Fee Models

- Zero-Fee Trading: Platforms like MEXC offer 0% maker fees for spot trading.

- Promotional Waivers: Binance provides zero-fee trading for select pairs or periods.

- Volume-Based Discounts: Kraken offers 0% maker fees for high-volume traders.

- Decentralised Exchanges (DEXs): Matcha charges no platform fees, only blockchain gas fees.

Benefits of Low-Fee Exchanges

- Cost Savings: Low fees enhance profit margins, especially for high-frequency traders.

- Accessibility: Beginners with small budgets can trade without significant fee burdens.

- Increased Liquidity: Low fees attract more traders, improving trade execution.

- Competitive Advantage: Platforms with the lowest crypto fees stand out in a crowded market.

Also Read: Best AI Tools for Students

Potential Drawbacks

- Hidden Costs: Wider spreads or withdrawal fees may offset savings.

- Limited Features: Some low-fee platforms offer fewer trading pairs or tools.

- Sustainability Concerns: Maintaining low fees long-term may challenge platform profitability.

- Variable Gas Fees: DEXs like Matcha incur network-dependent gas fees, which can be high during congestion.

Best Cheapest Crypto Exchanges with Lowest Fees

MEXC

MEXC is renowned as the cheapest crypto exchange, offering 0% maker and 0.02% taker fees for spot trading across 2,500+ cryptocurrencies, making it ideal for cost-conscious traders. Founded in 2018, it serves over 10 million users with spot, futures, margin, and copy trading. Futures fees are competitive at 0% maker and 0.01% taker. MEXC also hosts zero-fee trading events and weekly airdrops, enhancing savings. Security includes 2FA, cold storage, and KYC/AML compliance. The platform’s user-friendly interface suits beginners, while its vast altcoin selection appeals to advanced traders. However, wider spreads may apply, and withdrawal fees vary by asset. MEXC’s low fees and extensive offerings make it a top choice for those seeking a crypto exchange with the lowest fees.

Also Read: 8 Best AI Recruiting Tools

Binance

Binance, the world’s largest crypto exchange, offers a low-fee structure with 0.1% maker and taker fees, reducible to 0.075% with BNB token holdings. It provides zero-fee trading on select stablecoin pairs and the “Convert” feature for crypto swaps. Supporting 500+ cryptocurrencies, Binance offers spot, futures, and staking, with advanced tools for all trader levels. Security features include encryption, SAFU fund, and 2FA. From March to September 2025, Binance Wallet users will enjoy zero-fee trading on all pairs. While standard fees apply outside promotions, Binance’s versatility and discounts make it a leading crypto exchange with lowest fees. Traders should note potential withdrawal fees and limited zero-fee pair availability.

Also Read: KuCoin vs Binance: Read this before choosing? [Important]

KuCoin

KuCoin, dubbed the “People’s Exchange,” offers competitive fees with 0.1% maker and taker rates, reducible to 0.08% with KCS token holdings. Its “KuCoin Convert” feature provides zero-fee crypto swaps for 26 assets, and periodic promotions waive fees on select pairs. Supporting 700+ cryptocurrencies, KuCoin offers spot, futures, margin, and lending. Higher VIP tiers can achieve zero maker fees. Security includes 2FA, cold storage, and regular audits. KuCoin’s user-friendly interface and altcoin variety make it a strong contender for the crypto exchange with lowest fees, though zero-fee trading is limited to specific features or promotions. Traders should check for withdrawal fees and spread costs to ensure cost-effectiveness.

Also Read: 20 Best Crypto Exchange Reddit Communities

Phemex

Phemex provides zero-fee spot trading for premium members (subscriptions from $9.99/month), making it a cost-effective option for frequent traders. Non-premium users face 0.01% maker and 0.06% taker fees. Launched in 2019, Phemex supports spot and perpetual futures with up to 100x leverage, and offers 0% withdrawal fees. Phemex Token (PT) holders gain additional discounts. Security features include no KYC for basic trading, 2FA, and cold storage. With 350+ cryptocurrencies, Phemex caters to diverse trading needs. Its subscription model ensures low fees, but non-premium users face higher costs, and U.S. traders face restrictions. Phemex’s low withdrawal fees and trading bots enhance its appeal as a crypto exchange with lowest fees for premium users.

Also Read: A Candid Explanation of Bitcoin

Bybit

Bybit offers periodic zero-fee trading promotions, such as the “Indices Unleashed” event (March 14–April 12, 2025), covering select index pairs. P2P trading is also fee-free. Standard fees are 0.1% for both maker and taker, with volume discounts reducing them to 0.005%/0.015%. Supporting 200+ cryptocurrencies, Bybit provides spot, futures, and copy trading, with AI tools like TradeGPT. Security includes 2FA, cold storage, and Certik audits. While zero-fee trading is promotional, Bybit’s competitive fees and innovative features make it a strong crypto exchange with the lowest fees. Traders should verify promotion terms and withdrawal fees for cost-effectiveness.

Also Read: Top 5 Open-Source Trading Bots on GitHub

Gate.io

Gate.io offers zero-fee trading on USD spot pairs since September 2022, covering 50+ pairs. Standard fees are 0.1% maker/taker, with discounts for high-volume traders. Supporting 1,000+ cryptocurrencies, Gate.io provides spot, futures, margin, and lending. Security includes 2FA, cold storage, and KYC/AML compliance. Its extensive cryptocurrency selection and additional earning options like lending make Gate.io a competitive crypto exchange with the lowest fees. Traders should note potential withdrawal fees and wider spreads on non-USD pairs, ensuring they align with trading strategies.

Also Read: Best MLOps Platforms: Streamlining AI and ML Operations

Best Wallet

Best Wallet, a decentralised exchange aggregator, offers zero platform fees, with users only paying blockchain gas fees. Connecting to 200+ DEXS, it supports multiple blockchains like Ethereum and Polygon, offering staking and yield farming. Its non-custodial nature ensures user control over private keys, enhancing security. While gas fees vary with network congestion, Best Wallet’s zero trading fees make it the cheapest crypto exchange for decentralised trading. Limited fiat on-ramps and variable gas costs require careful consideration.

Also Read: Top 7 Best Open Source LLMs to try

CZR Exchange

CZR Exchange, launched in 2024, offers zero-fee spot trading across 500+ tokens, positioning it as a new but competitive crypto exchange with the lowest fees. It emphasises speed, security, and transparency, with advanced tools for all trader levels. Security features include multi-layer encryption and compliance measures. While details on other fees are limited, CZR’s zero-fee model and broad cryptocurrency support make it appealing. As a new platform, traders should verify spreads and long-term reliability before committing.

Also Read: Chatbase Review: Build AI chatbots without coding

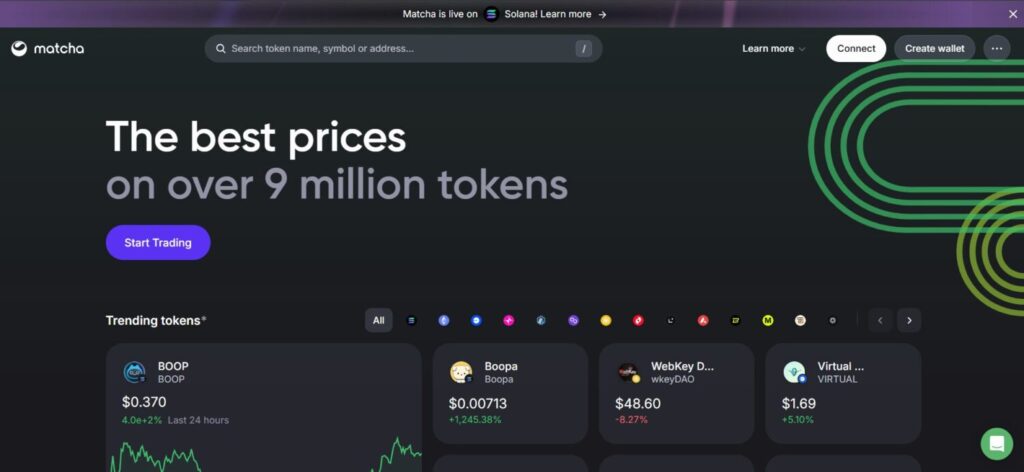

Matcha

Matcha, a DEX aggregator by 0x, offers zero platform fees, with users paying only gas fees. Sourcing liquidity from 100+ DEXs, it supports thousands of tokens across Ethereum, Polygon, and Binance Smart Chain. Features like “Matcha Auto” cover gas fees upfront, enhancing cost-effectiveness. Matcha’s non-custodial platform ensures security via Ethereum’s infrastructure. While gas fees can be high during congestion, layer-2 solutions reduce costs, making Matcha a crypto exchange with the lowest fees for decentralised trading. Traders should monitor network fees for optimal savings.

Also Read: Best AI Agents: The Future of Autonomous AI in Business

Fee Comparison Table

| Exchange | Maker Fee | Taker Fee | Crypto Deposit Fee | Withdrawal Fee | Unique Feature |

|---|---|---|---|---|---|

| MEXC | 0% | 0.02% | Free | Varies by asset | Zero-fee trading events |

| Binance | 0.1% | 0.1% | Free | Varies by asset | 25% BNB discount, zero-fee promotions |

| KuCoin | 0.1% | 0.1% | Free | Varies by asset | Zero-fee conversions, KCS discounts |

| Phemex | 0.01%* | 0.06%* | Free | 0% | Zero-fee for premium members |

| Bybit | 0.1% | 0.1% | Free | Varies by asset | Zero-fee P2P trading, promotions |

| Gate.io | 0.1% | 0.1% | Free | Varies by asset | Zero-fee USD pairs |

| Best Wallet | 0% | 0% | N/A (DEX) | Gas fees | Non-custodial, multi-chain |

| CZR Exchange | 0% | 0% | Free | Varies by asset | New platform, zero-fee spot trading |

| Matcha | 0% | 0% | N/A (DEX) | Gas fees | Gasless trades via Matcha Auto |

How Low-Fee Exchanges Operate

Low-fee exchanges sustain operations through:

- Spreads: Wider buy-sell price gaps generate revenue.

- Withdrawal Fees: Charges for fund transfers vary by asset.

- Token Discounts: Holding exchange tokens like BNB or KCS reduces fees.

- Promotions: Temporary zero-fee periods attract users.

DEXs like Matcha rely on gas fees, which fluctuate with network activity. This requires traders to monitor blockchain conditions.

Also Read: 5+ Best AI Music Generators of 2024

Choosing the Right Low-Fee Exchange

Consider these factors:

- Security: Prioritize 2FA, cold storage, and regulatory compliance.

- Liquidity: High liquidity ensures efficient trade execution.

- Supported Assets: Ensure desired cryptocurrencies are available.

- User Interface: A user-friendly platform enhances trading efficiency.

Tips include leveraging token discounts, checking KYC requirements, and monitoring spreads to maximise savings.

Also Read: Keevo Wallet Review – A Secure Vault for Cryptocurrency

User Experiences

Traders report significant savings on low-fee platforms. MEXC users save thousands annually due to zero maker fees, while Binance’s BNB discounts and zero-fee promotions are praised for flexibility. KuCoin’s “Convert” feature is popular for fee-free swaps, and Kraken’s low fees attract high-volume traders. These experiences underscore the value of choosing a crypto exchange with the lowest fees for cost-effective trading.

Conclusion

For traders seeking the cheapest crypto exchange with the lowest fees in 2025, MEXC leads with 0% maker and 0.02% taker fees, followed closely by Binance, Kraken, and Lykke. Platforms like Phemex, KuCoin, Bybit, Gate.io, Best Wallet, CZR Exchange, and Matcha also offer competitive low-fee structures, catering to diverse trading needs. While low fees enhance profitability, traders should consider spreads, withdrawal fees, and platform reliability. Users can select the best crypto exchange with the lowest fees by evaluating security, liquidity, and supported assets. Explore platforms like MEXC or Binance to optimise trading costs and stay ahead in the dynamic crypto market.

Frequently Asked Questions(FAQs)

What are low-fee crypto exchanges?

Low-fee crypto exchanges charge minimal or zero maker and taker fees—typically lower than the industry average of 0.1%–0.5%. Some platforms offer zero-fee promotions, token-based discounts, or rely on alternate revenue like wider spreads and withdrawal fees.

Why should I use a crypto exchange with the lowest fees?

Using low-fee exchanges maximizes your profits, especially if you’re a frequent trader. Lower fees reduce the cost of each transaction, improving your return over time.

Which is the cheapest crypto exchange in 2025?

MEXC is currently the cheapest, offering 0% maker and 0.02% taker fees across thousands of assets. Others like Lykke and CZR Exchange also offer zero-fee trading but may have smaller asset selections.

Are there any hidden fees on low-fee platforms?

Yes. Some platforms compensate for low trading fees by charging higher withdrawal fees, offering wider spreads, or limiting zero-fee features to premium users or promotional periods.

How do token discounts work?

Exchanges like Binance and KuCoin offer fee discounts if you hold their native tokens (e.g., BNB or KCS). These discounts are typically applied automatically when paying trading fees with the token.

What’s the difference between maker and taker fees?

Maker fees apply when you add liquidity to the order book (limit orders), while taker fees apply when you remove liquidity (market orders). Some platforms offer lower or zero maker fees to encourage liquidity.

How can I maximize savings on these platforms?

Use native token discounts, join during zero-fee promotions, check for low-spread pairs, and avoid high withdrawal fees. Consider subscribing to premium plans (e.g., Phemex) if you trade frequently.