Bit Digital plans to expand share cap to 1B to advance Ethereum strategy

Key Takeaways

- Bit Digital plans to triple its authorized share capital to 1 billion ordinary shares to fund its Ethereum growth strategy.

- The expanded share authorization aims to allow for substantial equity financing focused on purchasing Ethereum.

Share this article

Bit Digital, the digital asset miner pivoting from Bitcoin to Ethereum treasury, will hold a key shareholder meeting in September to seek approval to triple its authorized share capital in support of its Ethereum accumulation plan and growth initiative, a Friday SEC filing has revealed.

The company plans to raise the number of authorized ordinary shares from 340 million to 1 billion, increasing its authorized share capital from $3.5 million to $10.1 million. Preference shares would remain capped at 10 million.

“Our management believes that our current authorized share capital is not sufficient for our needs,” the company said in the filing.

The proposal requires approval from a majority of ordinary and preference shareholders. The board unanimously recommended that shareholders vote in favor of the increase.

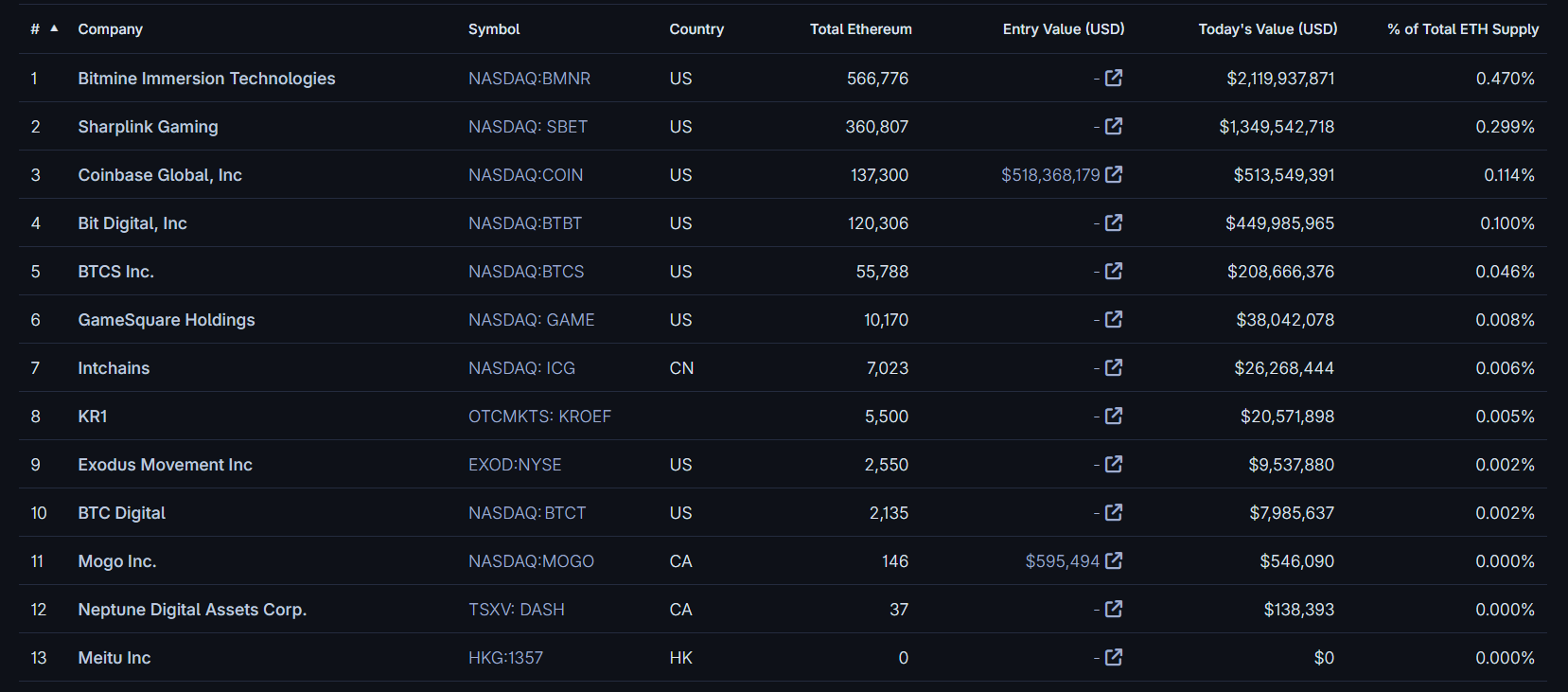

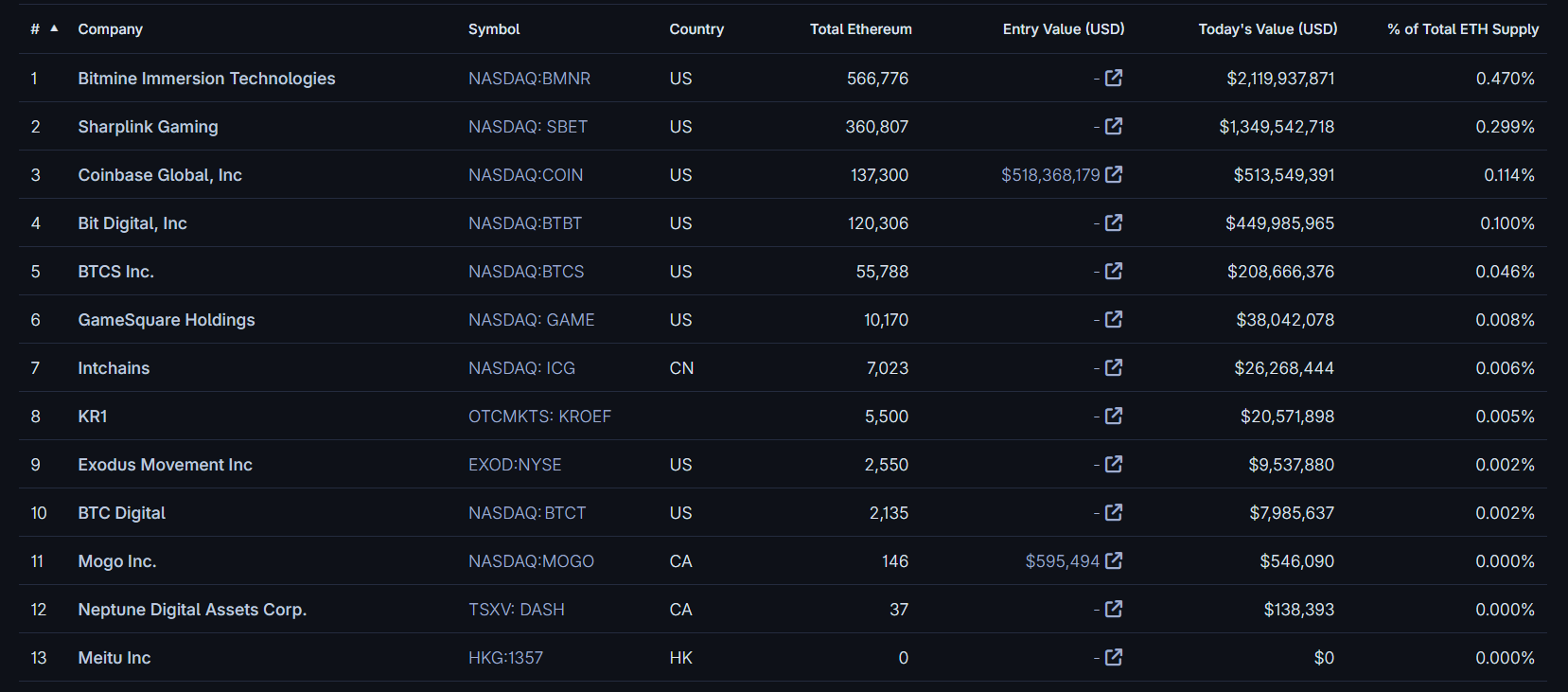

Bit Digital has grown its Ethereum holdings to 120,306 ETH, valued at approximately $450 million, CoinGecko data shows. It is one of the largest publicly traded institutional holders of Ethereum, trailing behind only Bitmine Immersion Technologies and SharpLink Gaming.

Bit Digital CEO Sam Tabar said Ethereum holds great promise as a foundation for a future digital financial infrastructure due to its programmability, widespread adoption, and staking yield.

Share this article